Introduction

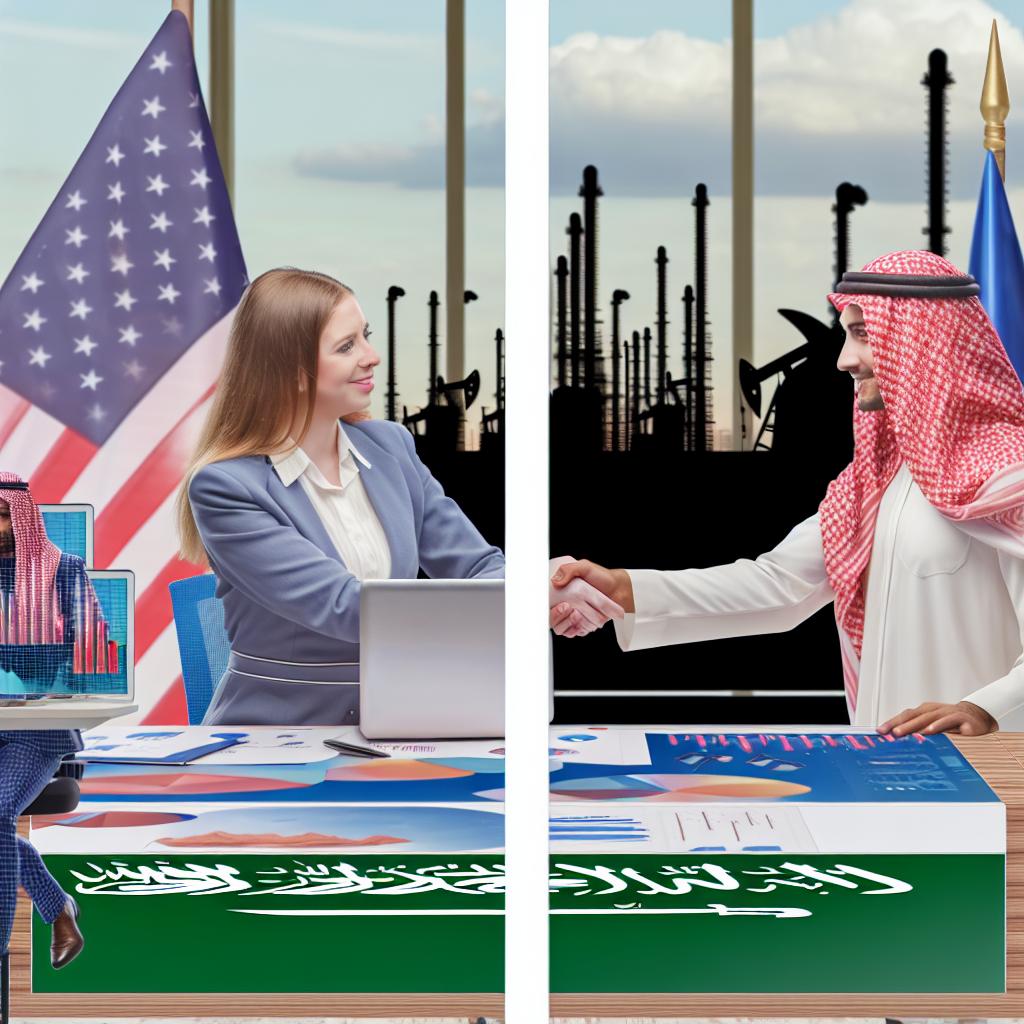

The relationship between the United States and Saudi Arabia has been defined by a series of strategic and economic partnerships that have evolved over the decades. This bilateral relationship, with its complexities and mutual benefits, continues to make headlines and has a profound impact on both regional and global economic landscapes. The opportunities for investment between these two nations are vast and ever-evolving, providing ample prospects for businesses and investors to tap into new markets and expand their global reach. This document delves into the intricacies of these opportunities and the potential challenges that may accompany them, offering insights and analysis crucial for stakeholders interested in the Saudi investment scene.

Opportunities for US Investment in Saudi Arabia

The Saudi market is emerging as one of the key global investment destinations, especially for US investors looking to capitalize on new growth avenues. Below, we explore some of the vital opportunities available.

Vision 2030 Initiative

The Saudi Vision 2030 initiative has been a game changer in the Middle East’s economic landscape. This ambitious economic and social reform plan aims to diversify the Kingdom’s economy away from oil dependency by empowering other critical sectors like renewable energy, technology, and infrastructure. For US investors, this presents a golden opportunity to join hands with Saudi entities in the realms of green technology and sustainable development projects.

Investors can partake in large-scale infrastructure ventures, ranging from constructing modern smart cities to the execution of major public transportation projects. The push for a sustainable economy also opens doors for significant investments in solar, wind, and other renewable energies, aligning with the global shift towards sustainable energy solutions.

Growing Market

Saudi Arabia’s economy stands as one of the largest and most dynamic in the Middle East and North Africa (MENA) region. This dynamic nature is largely attributed to its young and burgeoning population, which creates a desirable consumer base for diverse US goods and services. Importantly, the country’s rapidly urbanizing and technologically advancing population presents an opportunity for US businesses to offer innovative solutions and products.

Sectors like healthcare, education, and entertainment are witnessing exponential growth to satisfy the needs of a population becoming increasingly sophisticated and informed. Healthcare infrastructure is being expanded upon to cater to an ever-growing population, creating opportunities for investments in medical technology and healthcare services. Similarly, educational reforms aim to create a knowledge-based economy, thereby inviting investments in educational technologies and professional development services.

Strategic Location

Saudi Arabia’s geography plays a crucial role in its economic strategy. Positioned strategically at the nexus of Europe, Asia, and Africa, it serves as a premium hub for US businesses aspiring to extend their operations abroad. This geographic advantage is supplemented by well-developed infrastructural frameworks, such as its state-of-the-art ports and airports, which facilitate seamless and efficient trade and logistics.

Such efficient infrastructure and favorable trade routes provide US companies the capability to streamline their supply chains and optimize their operations across various neighboring regions. Moreover, Saudi Arabia’s commitment to expanding its logistical capabilities ensures long-term benefits for companies looking to secure their strategic foothold in regional and international markets.

Challenges to Consider

Despite opportunities, investors must navigate several challenges to ensure profitable and sustainable business ventures in Saudi Arabia.

Regulatory Environment

Saudi Arabia’s regulatory landscape has evolved considerably in recent years, aiming to accommodate international investors and industry stakeholders. However, the intricate nature of the local laws and their enforcement remains a potential hindrance. US investors might face challenges due to complex bureaucratic processes, variations in regulatory practices, and the enforcement of new business reforms.

To mitigate these risks, it becomes imperative for businesses to thoroughly understand and comply with local laws and regulations. Adopting a proactive approach towards regulatory compliance could potentially safeguard against misunderstandings, delays, and potential legal issues.

Cultural Factors

Engaging in business activity in Saudi Arabia requires a nuanced understanding of local cultural contexts and social norms. US businesses should be equipped with culturally competent strategies to address and adapt to these nuances, which can significantly impact their business relationships and operations.

The importance of cultural sensitivity cannot be overstated when navigating local partnerships and collaborations. Customary business practices, negotiation styles, and the traditionally hierarchical business environment should be acknowledged and respected to achieve meaningful engagement with local partners and consumers.

Geopolitical Tensions

Geopolitics plays a crucial role in the economies of both the US and Saudi Arabia. The changing dynamics within this landscape can influence economic relationships and business opportunities. Investors, therefore, need to remain resilient and informed about any pertinent geopolitical developments that could impact their ventures.

This includes being vigilant about diplomatic relations, trade agreements, and regional stability situations that could affect market conditions. By staying well-informed and strategically agile, US investors can better position themselves to respond to and navigate potential geopolitical disruptions.

Conclusion

In conclusion, the scope for US investment within Saudi Arabia offers promising prospects catalyzed by the Kingdom’s progressive economic reforms and forward-thinking strategic initiatives under Vision 2030. Investors keen on pursuing opportunities in this emerging market ought to be cognizant of the local challenges, including regulatory intricacies and cultural need for understanding and adaptability. By proactively addressing these challenges, US businesses can effectively leverage emerging opportunities to establish a strong and resilient presence in the dynamic Saudi market. For further insights into the evolving investment landscape in Saudi Arabia, prospective investors and businesses can refer to reliable resources like the Invest Saudi website for an in-depth understanding of the available opportunities and services.

This article was last updated on: March 2, 2025